Climate Change Initiatives (TCFD-Based Disclosure)

Climate Change Initiatives (TCFD-Based Disclosure)

The Mitsubishi Electric Group has expressed its support for the recommendations of the TCFD, and as such, the Group promotes efforts and discloses information in line with these recommendations.

Governance

Promotion System

In fiscal 2023, the Group positioned the realization of sustainability at the cornerstone of its management policy. To achieve sustainability, it has established a framework that promotes initiatives from the two perspectives: “value creation” and “foundation enhancement.”

Regarding climate change response, the Sustainability Committee, commissioned by the Executive Officers’ Meeting, discusses policies and measures aimed at reducing greenhouse gas emissions from the Group and achieving carbon neutrality throughout the entire value chain. The Sustainability Innovation Group oversees and analyzes risks, opportunities, and their financial impact.

Policy for Initiatives

Under our long-term environmental management vision through 2050, titled Environmental Sustainability Vision 2050, we aim to achieve carbon neutrality in our factories and offices by fiscal 2031 and to reduce greenhouse gas emissions throughout the entire value chain to net-zero by fiscal 2051. In February 2024, we updated our short-term plan, Environmental Plan 2025 (fiscal 2025-2026), based on the Environmental Sustainability Vision 2050, aiming to achieve even higher targets than those certified by the Science Based Targets (SBT) Initiative in the same month.

Strategy

The Mitsubishi Electric Group views the transition to a decarbonized society not as a business risk but as an opportunity common to all its businesses. Based on this recognition, we are integrating initiatives related to Environmental Sustainability Vision 2050, Environmental Plan 2025, and SBTs into our business strategies and advancing technological and business development accordingly.

Business Strategy

The Group leverages its strengths across a wide range of businesses to promote energy conservation, electrification, effective utilization of renewable energy, and the transition to business models with high resource circularity. Through these efforts, the Group aims to accelerate the reduction of environmental impact across society.

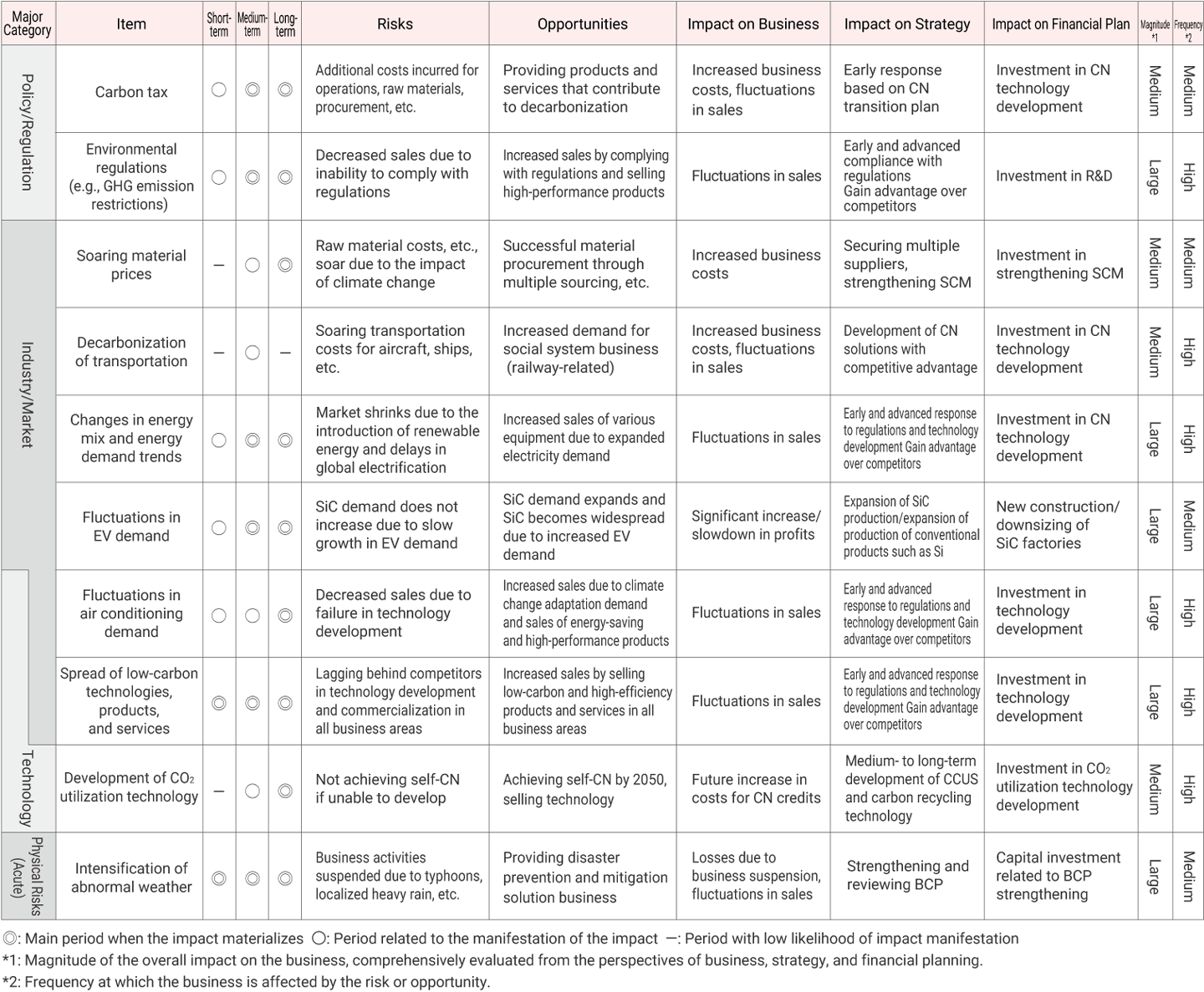

Climate Change Risks and Opportunities in the Short, Medium, and Long Terms

The Group assesses the impact of climate-related risks and opportunities that are expected to affect each of its businesses in the short term, medium term, and long term, referring to climate scenarios presented by external organizations (such as the IEA) and economic development projections for each country and region.

Periods

Short term: Period through fiscal 2026 (period of the Environmental Plan 2025 and the medium-term management plan)

Medium term: Period through fiscal 2031

Long term: Period through fiscal 2051 (final year of the Environmental Sustainability Vision 2050)

Magnitude of Impact

Under the supervision of the Executive Officer in charge of Sustainability, the executive officers and heads of relevant business divisions determine whether the anticipated events in each business qualify as significant risks (high impact).

Climate-Related Risks and Opportunities in the Short, Medium, and Long Terms

Risks Related to Climate Change

Climate-related risks can be broadly divided into risks associated with the transition to a decarbonized society (transition risks) and risks associated with the physical impacts of global warming (physical risks). These risks can result in increased costs (for production, internal management, financing, etc.) and decreased revenues.

If the transition to a decarbonized society, which is the premise of the Group’s business strategy, progresses, it is expected that there will be an increase in social demand for reducing greenhouse gas emissions in all products and services, changes in energy supply and demand, changes in the energy mix due to increased power generation from renewable energy sources, and the progress of the electrification of automobiles (shift to EVs). Moreover, in this case, transition risks such as the tightening of regulations on greenhouse gas emissions, increased burden of technological development, and delays in technological development could exceed physical risks.

To address transition risks, the Mitsubishi Electric Group is already working to reduce greenhouse gas emissions by implementing its environmental plan and setting SBTs. So, for example, even if regulations on greenhouse gas emissions are tightened, we believe that the impact will be minor. We estimate that, even if material prices soar, the impact can be minimized by more vigorously pursuing environmentally conscious design, which will in turn also support the global warming countermeasures, resource conservation, and recyclability that we are already working on. Moreover, in anticipation of the tightening of regulations such as air conditioning refrigerant regulations and the development competition for low-carbon and high-efficiency technologies, we are strategically combining short-term, medium-term, and long-term R&D investments to drive technological advancement. Additionally, we are also making capital investments in environmental activities, including global warming countermeasures such as energy conservation.

On the other hand, if economic development is prioritized over climate change countermeasures in countries around the world, it is predicted that there will be an increase in the frequency of heavy rains and floods, intensification of extreme weather events, and chronic temperature increases. In this case, physical risks such as the suspension of operations due to disasters and the disruption of supply chains could exceed transition risks.

In response to physical risks such as floods, we have formulated a Business Continuity Plan (BCP), review it once a year, and are decentralizing our production sites. In the supply chain, we are also striving to purchase from multiple companies and requesting our suppliers to operate multiple plants to avoid situations that could hinder production.

Opportunities Related to Climate Change

The Group has a wide range of businesses and considers it a strength to be able to provide a wide range of products, services, and solutions that contribute to solving social issues caused by climate change. Therefore, we believe that we have sustainable growth opportunities from the short term to the long term.

Whether the world prioritizes transitioning to a decarbonized society or pursues economic development over climate change countermeasures, it is predicted that the needs for solving social issues caused by climate change will become more apparent.

The Group provides large energy storage systems, smart medium- and low-voltage direct current distribution network systems, distributed power source operation systems / virtual power plant (VPP) systems, SF6 gas-free circuit breakers, and multi-region digital energy management systems (multi-region EMS) to prepare for the expansion of electricity demand and the diversification of power supply required by the trend toward a decarbonized society. These products meet the needs for effective use of electricity and system stabilization arising with the expansion of renewable energy and the decentralization of power sources. In addition, the increase in demand for electrified products, driven by the progress of the electrification of automobiles (shift to EVs), will lead to an expansion of demand for Silicon Carbide (SiC), high-efficiency power semiconductors in the Semiconductors & Devices business, and a reduction in their manufacturing costs. The expansion of SiC applications in the fields of electric railways, electric power, industry, and consumer products is anticipated.

Even if economic development is prioritized over climate change countermeasures, it is expected that revenue opportunities will expand as we contribute to the realization of a decarbonized society by providing highly energy-efficient products, services, and solutions in the air conditioning business and other areas, in response to the increase in demand due to the development of the global economy and the increase in purchasing power, as well as the increase in demand for adaptation to climate change.

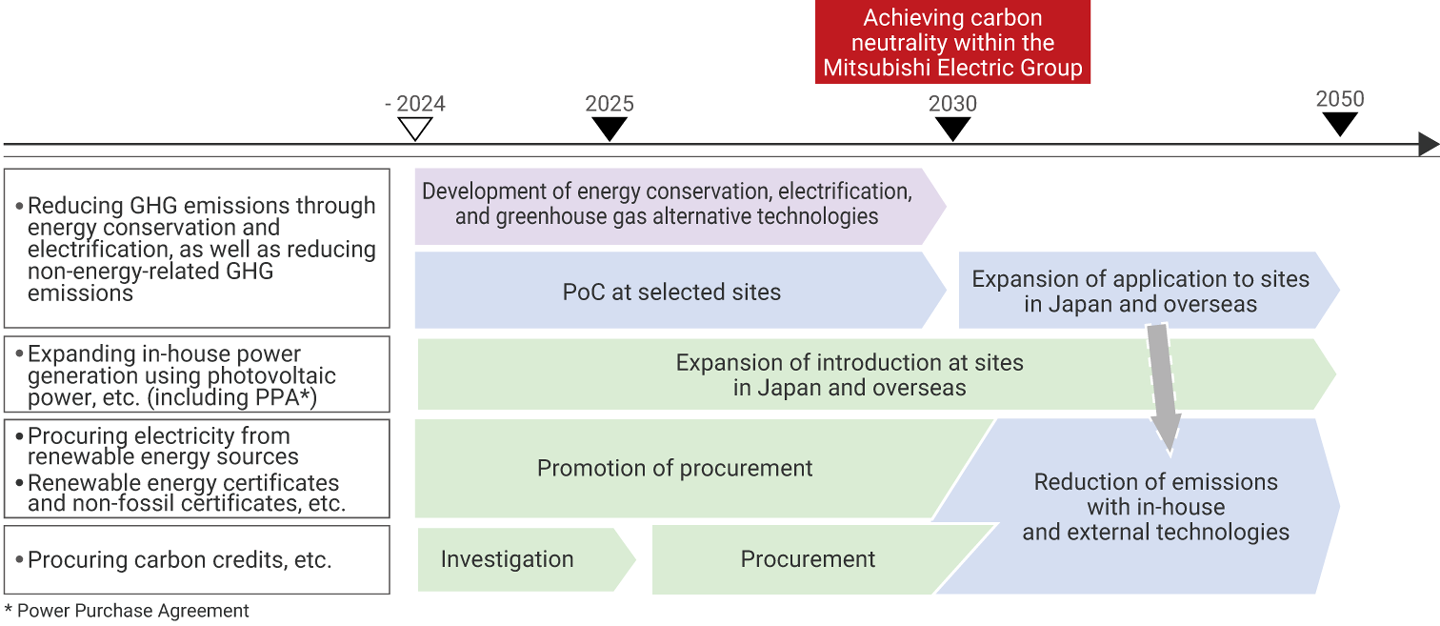

Carbon Neutrality Transition Plan

The Group has formulated and is implementing a plan to transition to carbon neutrality, aiming to eliminate greenhouse gas emissions from factories and offices by fiscal 2031 and throughout the entire value chain by fiscal 2051.

Roadmap for Reducing GHG Emissions from Factories and Offices

We are driving a number of initiatives to achieve carbon neutrality in our factories and offices: (1) reducing GHG emissions through energy conservation and electrification, as well as reducing non-energy-related GHG emissions; (2) expanding in-house power generation using photovoltaic power, etc. (including PPAs); and (3) procuring renewable energy certificates and non-fossil certificates, etc. We are also considering (4) procuring carbon credits, etc.

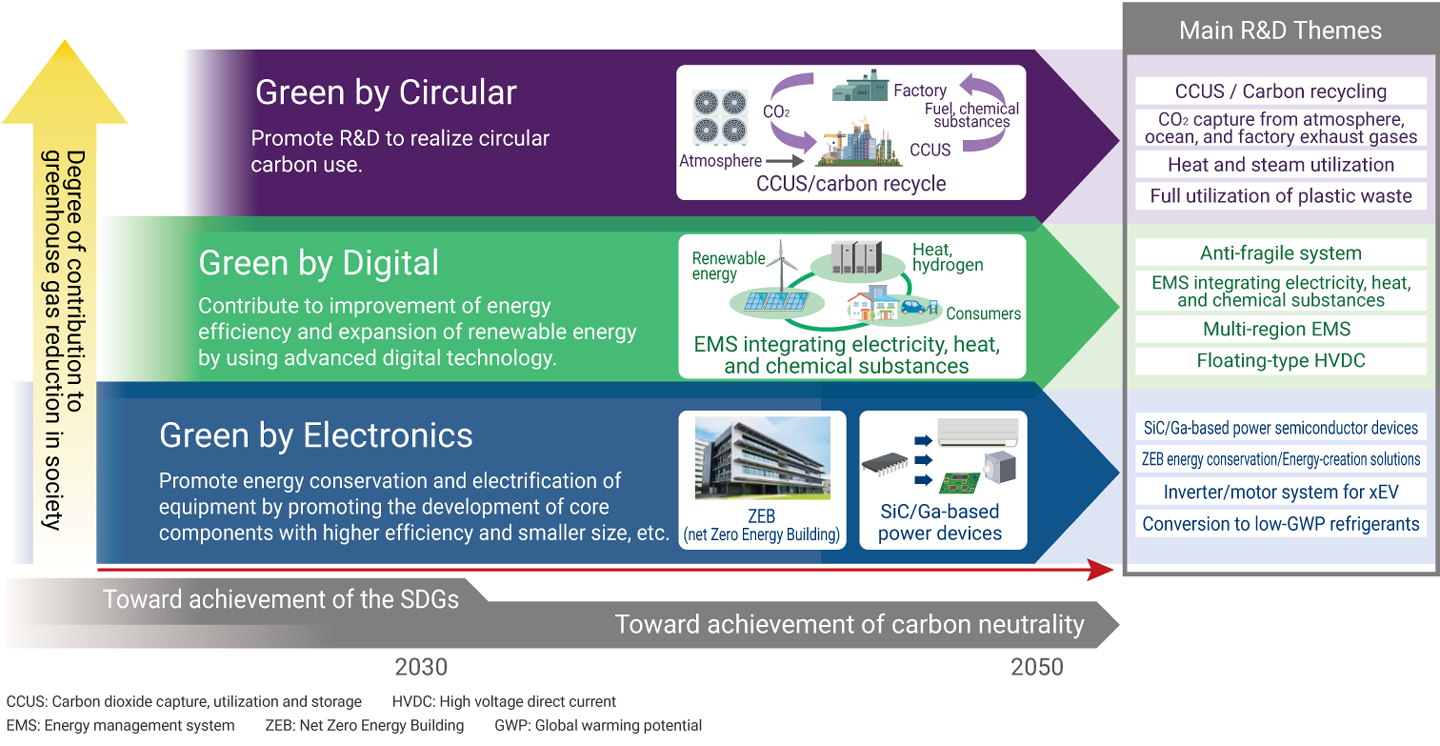

Research and Development Strategy for Achieving Carbon Neutrality

To create and grow businesses that contribute to the realization of carbon neutrality throughout the value chain and society as a whole, we will accelerate R&D in three innovation areas: Green by Electronics, Green by Digital, and Green by Circular. These initiatives are further strengthened through collaboration between industry, academia, and government.

Research and Development Roadmap for Achieving Carbon Neutrality

In Green by Electronics, we will advance R&D to improve the efficiency and reduce the size of power electronics and motors, the core components that are Mitsubishi Electric’s strengths, contributing to energy conservation and electrification of FA equipment, air conditioning, and other products. We will also advance R&D on net Zero Energy Buildings (ZEB), air conditioning and refrigeration systems using refrigerants with low global warming potential, and power devices using new materials. Furthermore, we will advance the research and development of optoelectronic fusion technology, which replaces electrical connections with optical connections for communication between Graphics Processing Unit (GPU) packages in data center servers.

In Green by Digital, we will use advanced digital technologies to improve energy efficiency and expand the use of renewable energy. For example, we will conduct research and development on an integrated energy management system (EMS) that manages and optimizes electricity, heat, and chemical substances. Through these activities, we will contribute to reducing greenhouse gas emissions throughout the entire value chain.

In Green by Circular, we will advance research and development focusing on resource circulation, such as CO2 capture, utilization, and storage (CCUS) for carbon recycling, as well as plastic recycling. It contributes to the realization of carbon circular utilization through technologies like the chemical looping method for CO2 reduction, which generates carbon monoxide (CO) as a usable resource, and AI-powered smart electrostatic sorting technology for mixed plastic fragments.

To create and expand businesses in these green-related fields, we plan to allocate approximately 900 billion* yen over the seven years from fiscal 2025 to fiscal 2031 to green-related research and development investments.

- Estimated figures calculated based on past achievements and growth rates

Resilience to Climate Change Based on Scenario Analysis

Overview

The Group conducts annual scenario analysis considering long-term future uncertainties based on two scenarios: one in which the world moves toward a decarbonized society as assumed in our business strategy (2°C or lower scenario*1), and another in which economic development is prioritized over climate change countermeasures (4°C scenario*2). We set fiscal 2041 as a point in an uncertain future and analyze the financial impact of transitioning to the 4°C scenario, with the baseline (extension of our business plan) as the 2°C or lower scenario.

- 1 The demand for decarbonization technologies increases and development competition intensifies due to stricter regulations. Electrification of society progresses, total electricity demand increases, and the percentage of renewable energy also rises.

<Referenced public scenarios>

- International Energy Agency (IEA) World Energy Outlook 2024, APS (Announced Pledges Scenario)

- Intergovernmental Panel on Climate Change (IPCC) 6th Assessment Report (AR6), Shared Socioeconomic Pathway (SSP1), compared to SSP2 as the current situation

- 2 Physical risks materialize due to decarbonization activities being at or below the current level. Consumer purchasing power increases compared to the 2°C or lower scenario. On the other hand, extreme weather events such as heavy rain and floods intensify.

<Referenced public scenarios>

- IEA World Energy Outlook 2024, STEPS (The Stated Policies Scenario)

- IPCC 6th Assessment Report, SSP5 (compared to SSP2 as the current situation)

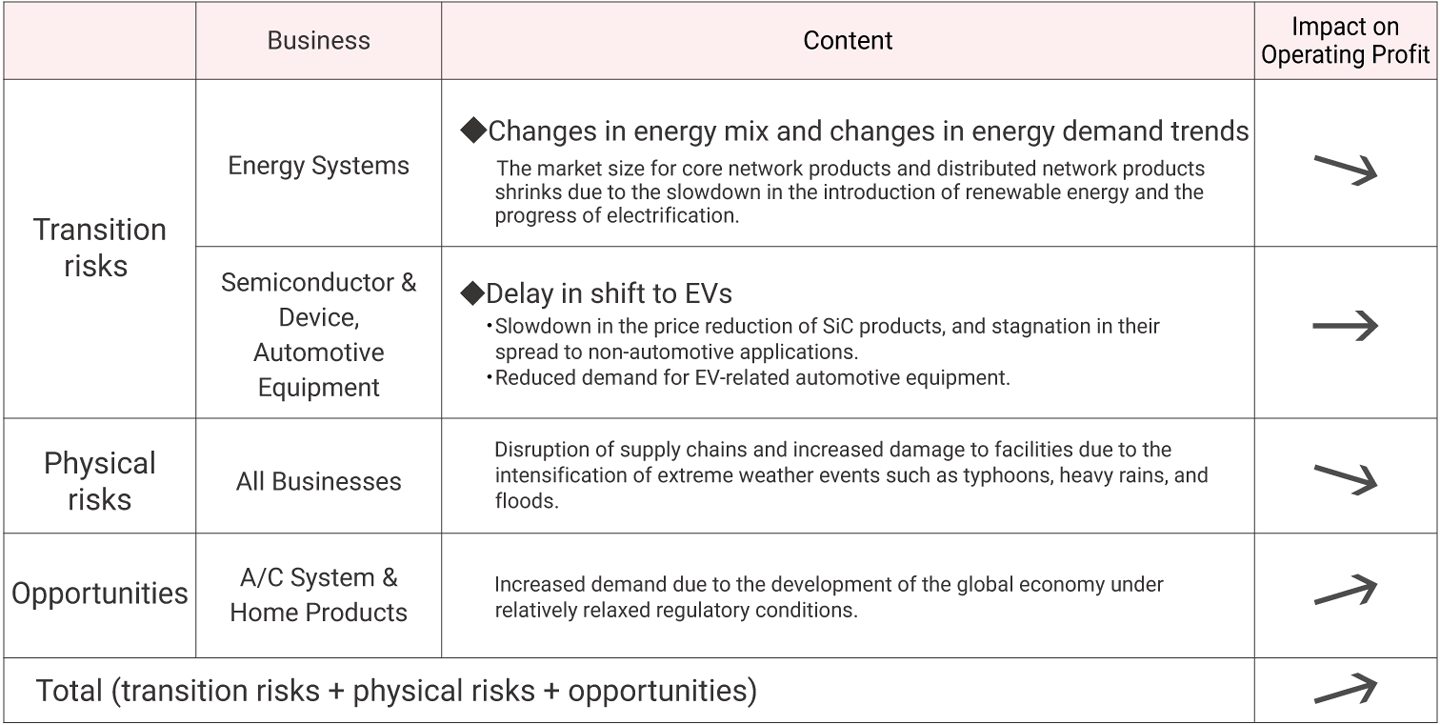

Scenario Analysis Results

The Mitsubishi Electric Group has examined climate-related risks and opportunities in all its business segments. Regarding transition risks, we evaluated that three businesses, Energy Systems, Automotive Equipment, and Semiconductor & Device would be significantly affected by climate change in the 4°C scenario relatively, and we quantitatively estimated the financial impact.

On the other hand, for physical risks, we estimated the financial impact on the Group’s major manufacturing bases across all business segments, taking the intensification of extreme weather events as an inevitable risk due to the increased frequency of extreme weather events.

The main transition risks that would affect finances due to the transition to the 4°C scenario are changes in the energy mix, changes in energy demand trends, and delay in shift to EVs.

The Energy Systems business is directly affected by changes in the energy mix and changes in energy demand trends, which would be expected to result in decreased profits due to the slow spread of renewable energy and sluggish growth in total electricity demand caused by delays in electrification. The Automotive Equipment and Semiconductor & Device businesses would experience some concerns such as the delay in the shift to EVs leading to reduced demand for EV-related automotive equipment and the failure of SiC manufacturing costs to decrease, stagnating its widespread use in other fields. However, the impact of these concerns is expected to be minimal.

Although these three businesses would be affected by reduced opportunities under the 4°C scenario, climate change is seen as more of an opportunity than a risk in all of the Mitsubishi Electric Group's businesses. In the case of the 4°C scenario, compared with the case of the 2°C or lower scenario, each country will adopt economy-first measures, and as a result, high-performance products and services will be selected and demand will increase vigorously. For example, in the air conditioning system & home products business, performance requirements for reducing greenhouse gas and energy consumption would not decrease, and increased demand for adapting to climate change can be expected.

Moreover, we estimate the financial impact of the intensification of extreme weather events, a physical risk, to be smaller than the impact of transition risks.

Based on this analysis, we expect a decrease in profit due to transition risks in the Energy Systems business, as well as physical risks in all businesses. However, the opportunities presented by climate change in many businesses, including the AC System & Home Products business, is also expected to bring an increase in profit. As a result, the impact on the Mitsubishi Electric Group is within the assumed range that can occur in normal business operations and is estimated to amount to a minor change in the direction of profit growth. For this reason, we do not foresee a significant financial impact even with a shift from the 2°C or lower scenario to the 4°C scenario.

Financial Impact on the Mitsubishi Electric Group When Society Progresses to the 4°C Scenario (Impact on Operating Profit)

Processes for Addressing Climate Change Risks and Opportunities

The Mitsubishi Electric Group uses its own business strategy decision-making process and a comprehensive risk management process to identify, assess, and manage risks and opportunities related to the global environment, including climate change.

Each of Mitsubishi Electric’s departments (business groups and corporate divisions) and affiliated companies in Japan and overseas identify climate change-related risks that are relevant to them, consider how to respond to such risks and turn them into opportunities, and proactively incorporate them into their business and divisional strategies.

At the same time, as part of the Mitsubishi Electric Group’s comprehensive risk management process, we identify, assess, and properly manage issues that have significant impacts on management in various risk areas, including risk management related to climate change.

The Group Risk Management System and Positioning of Global Environmental Risks

The Group’s global environmental and other risks, including risks related to climate change, are primarily managed by each corporate division of Mitsubishi Electric and its subsidiaries and affiliates in Japan and overseas. In addition, at the leadership of the Chief Risk Management Officer (CRO), the corporate division (i.e., the division responsible for the risk) identifies, assesses, and manages risks based on its knowledge in each area of expertise.

Risks in each specialty area identified and assessed by the divisions responsible for such risks are consolidated by the Corporate Legal Risk Management Group, and their impacts on group management are evaluated through relative comparisons among each risk, etc. The Risk Management and Compliance Committee, chaired by the CRO, makes management decisions.

Risks comprehensively assessed through the above process are shared with relevant parties, including management. The Group considers global environmental risks, including climate change, to be highly material because they have significant impacts on the realization of a sustainable global environment, one of the Group’s materialities.

Management Process for Risks Related to the Global Environment

Global environmental risks, including climate change, are identified, assessed, and managed by the Executive Officer in charge of sustainability and the Sustainability Innovation Group, the department in charge of risk, under the leadership of the CRO, in accordance with the Mitsubishi Electric Group risk management system described above.

Based on the results of such comprehensive risk assessment, the Executive Officer in charge of sustainability and the Sustainability Innovation Group identify and assess risks by subdividing global environmental risks into smaller risks, taking into account legal trends, technological trends, market trends, external evaluations, and other factors. Based on the results, the Executive Officer and the Department formulate an environmental plan as a medium-term risk management measure and an Environmental Management Plan as a one-year measure.

Each group organization (business group, affiliated company, etc.) formulates its own annual Environmental Management Plan based on these plans and reports the results to the Executive Officer in charge of sustainability and the Sustainability Innovation Group.

The Executive Officer in charge of sustainability and the Sustainability Innovation Group then review the results of the identifying and assessing of global environmental risks, taking into account the results of each organization and social trends, and in turn report the results to the Corporate Legal and Risk Management Group and, if necessary, revise the environmental plan and reflect the results in the Environmental Management Plan for the following fiscal year.

Metrics and Targets

The Mitsubishi Electric Group calculates and tracks greenhouse gas emissions (Scope 1, 2 and 3) in its value chain. For calculation and assessment, we refer to the GHG Protocol and the Basic Guidelines on Accounting for Greenhouse Gas Emissions Throughout the Supply Chain published by Japan’s Ministry of the Environment.

Long-Term Target

In our long-term environmental management vision through 2050, Environmental Sustainability Vision 2050, the Mitsubishi Electric Group has set a target to reduce greenhouse gas emissions throughout the entire value chain to net-zero by 2050.

Medium-Term Target

The Group is working toward the target of achieving carbon neutrality in our factories and offices by fiscal 2031, by reducing greenhouse gas emissions by a certain percentage each year.

<The Group’s reduction targets after receiving certification from the SBT initiative>

We have updated the Group’s greenhouse gas emission reduction targets for fiscal 2031 as follows, and received certification from the SBT initiative in January 2024. These new targets have been recognized as science-based targets for achieving the Paris Agreement’s “1.5°C target.” The Scope 1 and 2 targets have been certified as being at a level that “limits temperature rise to with 1.5°C,” while the Scope 3 target has been certified as being at a level “well below 2°C.”

- Scope 1 and 2: Reduce greenhouse gas emissions by 42% by fiscal 2031 compared to fiscal 2022 levels

- Scope 3* : Reduce greenhouse gas emissions by 30% by fiscal 2031 compared to fiscal 2019 levels

- The scope of Scope 3 has been expanded from the previous category 11 (use of sold products) to all categories.

Short-Term Target

Based on the action guidelines of Environmental Sustainability Vision 2050, the Mitsubishi Electric Group formulated an Environmental Plan that sets out specific activity targets. Under Environmental Plan 2025, the Group has set targets for fiscal 2026 that include reducing greenhouse gas emissions, estimating LC-CO₂* emissions using simplified methods, and advancing goals in the area of nature positive.

- Life cycle CO2: All CO2 emissions throughout the entire life cycle of products and services

Progress

See the table below for Scope 1 and 2 GHG emissions.

Market-based emissions are being reduced with the increasing use of renewable energy sources. We remain committed to reducing greenhouse gas emissions in pursuit of our Environmental Plan 2025 target: a reduction of 53% or more by the end of fiscal 2026 compared to fiscal 2014 levels.

Scope 1 and 2 Greenhouse Gas Emissions (Mitsubishi Electric Group) (Unit: kt-CO2)

| FY2023 | FY2024 | FY2025 | ||

|---|---|---|---|---|

Total of Scope 1 and 2 |

Market-based | 951 | 910 | 736 |

| Location-based | 1,046 | 1,071 | 992 | |

- Note: The data for fiscal 2025 have undergone third-party assurance by KPMG AZSA Sustainability Co., Ltd., as documented in the Mitsubishi Electric Group Sustainability

Data Book 2025.